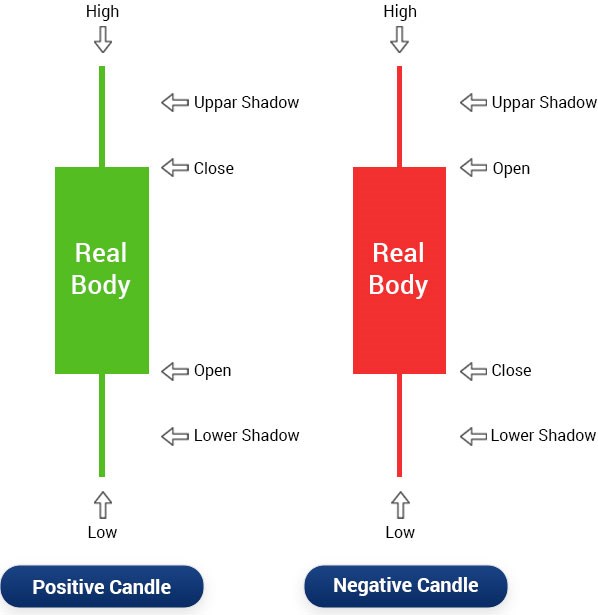

With regards to specialized analysis, candlestick maps are among the most popular equipment that forex traders use. These charts offer a very clear and concise way to visualize value activity, and they enables you to location prospective buying and selling possibilities.

However, before you begin while using types of candlesticks, there are some points you should know. In the following paragraphs, we’ll lightly talk about what candlestick graphs are and then dive into three significant technological indicators that you should look for when using these maps.

Practical Signs to Watch for When Utilizing Candlestick Graphs:

Now, let’s discuss three important technological indicators that you ought to watch for when you use these graphs.

1. The initial sign is named “assistance and amount of resistance.” As the label implies, help and level of resistance degrees reveal where prices will likely discover help or level of resistance. These degrees could be recognized by seeking patterns such as double bottoms or shirts, go and shoulder muscles habits, and so forth.

When these amounts are discovered, traders can then watch out for selling price activity to ensure these degrees as help or opposition. If price ranges relocate in support of the trader’s place after striking these ranges, it is actually a good indication the stage is valid.

2. The 2nd signal is named “pattern outlines.” Pattern line is merely right collections which can be attracted through cost levels or lows as a way to recognize the direction in the general tendency. Dealers are able to use pattern collections to enter or exit transactions, in addition to place cease-reduction orders placed.

3. The next and final signal we’ll discuss is called “energy.” Momentum procedures how quickly prices are moving in a particular direction. This will be significant as it can give dealers an early alert sign a trend is about to transform recommendations. Energy could be analyzed utilizing oscillators such as the Relative Power Crawl (RSI) or MACD.

Parting take note:

These are just three of the many technological signals that traders can make use of when trading with candlestick graphs. To be successful, it’s crucial that you try out distinct indications to see which of them job good for you. With more experience and determination, you’ll be able to place potential forex trading opportunities with ease!